Do you have a strategic plan in place for health insurance benefits? What are you doing to drive down health costs?

Do you have a strategic plan in place for health insurance benefits? What are you doing to drive down health costs?

Too many businesses look at their insurance program as a once-a-year decision and miss out on the opportunity for it to contribute to the overall company goals.

Many also overlook countless opportunities to generate the greatest ROI possible for the time and dollars invested in the program.

The Bureau of Labor Statistics reports that benefits typically account for over 30% ofpayroll expenses. That is a big portion of your overhead that you can’t afford not to prioritize. Yet many employers do not consider it when budgeting.

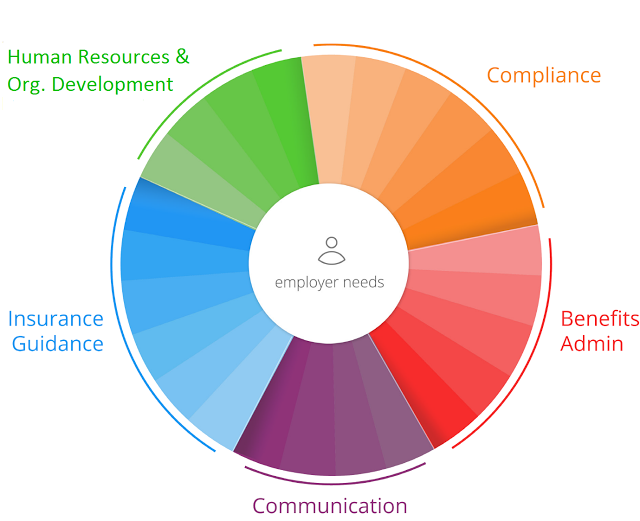

A well planned benefitsstrategy should lower costs, increase employee engagement and keep you compliant with the ever changing laws. Changes will not happen overnight; typically a multi-year plan will be necessary in order to truly increase benefit performance for your organization and your employees.

We advise looking at the entire suite of benefits during your evaluation process. Some questions to consider might include:

- How might you adjust the funding (fully insured, partially or totally self-funded) over time for the best fiscal result?

- How might you best utilize HSAs? HRAs? FSAs?

- Which ancillary benefits do you offer?

- Have you thought of voluntary benefits as a retention tool?

- What wellness strategy do you have in place?

- Has anyone explained the value of telemedicine?

- How might you use benefits as incentives to further engage your employees?

Photo Credit

Leave a comment