Last year I interviewed Bill for the WDA blog and it became one of our most read posts. So I thought I would further the conversation and see what a difference a year makes.

To read the original post visit Why We Do What We Do: An Interview with Bill Delmage.

Last year you talked about solving problems and being deeply curious about our clients. What would you say has changed in the past 12 months?

We have found that more than ever people are looking for guidance. People are not satisfied with the status quo. Often they do not understand healthcare or it's costs. I think we have reached a tipping point where people, individuals and employers alike, are beginning to realize they do have a voice in this confusing market and they want to know how best to use it.

The biggest impact we (consumers) can have is spending our healthcare dollars in a more deliberate way and in my experience employers want to do just that; so they turn to us for guidance. From an employer stand point that means you need to know where your premium and claims dollars are being spent. So the question is "When was the last time you did a healthcare consumption audit?"

Imagine I came to you as an employer looking for guidance. What would you tell me?

My first question would be do you have a 3-5 year healthcare plan? Healthcare isn't a sprint; to have meaningful impact you need to be in it for the long haul with a clear vision of the future.

It is not so different from what I told you last year: we would be deeply curious. We would have deep conversations about what you have in place, how your population engages with it, where the dollars are going, and what you envision for the future.

Then comes the education piece -- we would explore options you might not know about (Direct Primary Care, Level Funding, Pharmacy Fiduciary Responsibility, among others). We would also talk about the impact of change and ways to ease a transition from where you are to where you want to be. We see a good fit for many of our clients to step away from a traditional fully insured product into something that can rein in costs while offering rich benefits and better outcomes.

How do people respond to these new ideas? I imagine some are resistant.

It all depends on how much an employer and/or their group of employees is willing to engage. There is a learning curve when you change your program and you want to be sure it succeeds. That might mean taking small steps this year in order to be able to take the next step next year and the next year and so on.

My experience is that people feel cheated by the system but that many also don't understand it. So a big part of our job is to educate both on what is currently in place and how it could look different.

Have you hit any roadblocks this year?

Frustrations arise when desire to change and readiness for change aren't in sync.

In some cases the employer wants to try a new approach to healthcare and finds that the employees are reluctant because change feels uncertain. In others the employer doesn't want to make drastic changes and they feel shamed by the media that says only idiots are staying in the broken system. Both these situations can leave employers feeling powerless.

That is where we come in. No one can compare their situation to another company's because you aren't comparing apples to apples. Benchmarking can be a useful tool but over-comparison is not.

We need to zero in on what each client needs and how best to implement meaningful programs. I have talked a lot here about new strategies, but i don't want anyone to think they have to throw their whole framework out the window.

We can find ways to improve financial outlay and patient outcomes in nearly every situation. That means we can help you get the best starting where you are right now.

What have you found to be most satisfying this year?

It is so exciting to see business owners and CFOs take back control of healthcare spending! Many people mistakenly think the only options in our area are big carriers, but there are other options available. And you don't have to be a big company; there are solutions for small business too!

We've long imagined a world where you can build your own plan based specifically on your population. I am happy to report that we are there!!! It is exciting to put control back into the hands of the employer.

We see lots of opportunity to introduce our clients and prospects to out of the box solutions that are taking the industry by storm. And I truly feel that the education we have provided in renewals over the past 12 months has built a foundation for our clients explore how these options might fit within their plan and begin to see the change we have all been waiting for.

In your opinion, what was the most exciting outcome this year?

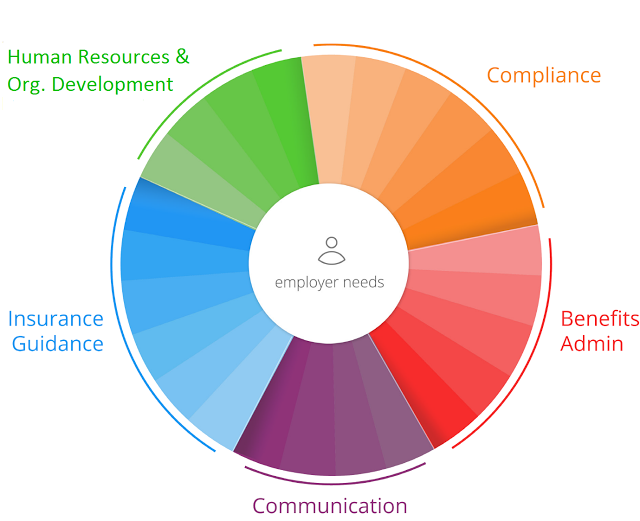

People are discovering what we have said for years, it is not enough to cover basic insurance needs and payroll, to really attract and retain talent you need to engage your people with your program and that takes a full suite of solutions many of which are not specifically insurance. They also see that they can't just shop and place insurance at open enrollment. Instead they need a multi year plan and a clear strategy to implement improvements overtime.

I think the most interesting thing to happen this year is not the new solutions (although they are quite compelling) but rather that in the past I encouraged my team to be curious and now I find that my clients are curious too. They want to dig deep and are open to new solutions. It is an exciting time in our office!

Leave a comment