Think you don’t need a Buy-Sell Agreement / Arrangement? You might want to reconsider.

Have you thought of all the situations that might necessitate one? There are many reasons besides mortality to consider a buy-sell agreement.

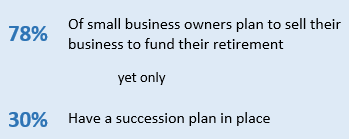

Retirement

Did you know that 78% of small business owners plan to use proceeds from the sale of their business to fund their retirement, yet only 30% actually have a succession plan in place? Over 90% of businesses in both RI and MA are small businesses. That means a lot of our local businesses do not have a plan in force.

Ending a Partnership

Let me give you an example. One of our clients is a successful business started by four partners. Ten years into the partnership one of them wanted out. The other three partners needed to buy out that share. Since they had an established a buy-sell agreement, the remaining three partners had a clear path to follow.

In their case they funded the buy-out with a life insurance product, so the partners did not need to come up with out of pocket cash. They were able to use the cash build up to fund the purchase. In such instances it is important to be careful in designating ownership and beneficiaries appropriately,.so be sure that your advisor understands the important issues surrounding these types of agreements.

Divorce

In some cases of divorce the spouse might have legal rights to part of the business. A good buy-sell agreement could outline terms for disposal of that asset such that the former spouse sells any interest received in a settlement back to the company or other owners using the valuation method established in the agreement.

Worst Case Scenario

And of course we must imagine the worst case scenario, a death without proper buy-sell planning. In this instance let’s say the family inherits the business. They may rush to sell in order to turn their inheritance into much needed cash. They may need to do that just to pay estate taxes within the 9 month deadline. Unfortunately, as is so often true of a s

ale under pressure, they will likely get far less than the true value.

If the sole beneficiary were a spouse they could possibly avoid the estate taxes but in the event that the business owner is single and/or the kids inherit due to provisions in a will or Trust, they may be burdened with the need for immediate cash.

Consider an alternative scenario, you could fund the buy sell with life insurance as well and have the company pay the estate tax. Problem solved.

Revisions

If do you have an agreement in place be sure to revisit it every few years to ensure the terms and coverages are still appropriate.

Leave a comment