You Ask:

Recently we have had several clients ask us the following question: If an active employee becomes Medicare eligible and enrolls in Medicare, is that a Cobra qualifying event for a dependent spouse and/or children on the employee’s plan?

Our Answer:

It is not a cut and dry situation. In the past employees who reached age 65 immediately retired and went on Medicare. That is often no longer the case with full retirement age increasing to age 67 and people working longer and longer.

You don’t have to be retired in order to qualify for Medicare so employees age 65 and over often ask whether or not they can stay on their employer’s group health coverage if they are entitled to Medicare and whether they should choose Medicare, the group coverage or both.

As is often the case, the answer is not simple.

Employer Responsibility to Employees

Employers must offer Medicare eligible employees the same group health options that they offer to any other active employee. The vast majority of people will be eligible for Medicare Part A at no cost since those premiums were paid throughout the employee’s working life. Everyone will pay a premium for Medicare Part B though and that premium cost will be dependent upon the employee’s income.

Most of today’s employees pay some portion of their health insurance premium. If they do pay for some portion of group insurance, they will need to determine whether or not they are required to pay both group premium and Medicare part B premiums if they elect to remain covered under the group insurance.

If the company employs 20 or more people, the employee cannot be required to sign up for Medicare Part B, but if the company employs fewer than 20 people they can. The reason for this is that when an employee of a company with fewer than 20 employees chooses to have both Medicare and group health insurance, Medicare is considered the primary insurer and therefore pays claims before the group coverage is responsible.

What About Dependents?

An important issue arises when an active employee becomes eligible for Medicare and that employee’s group coverage includes a younger spouse and/or dependent children. The question becomes whether or not those dependents are eligible to continue their group health coverage at their own cost (though at the group rates) under Cobra. The answer to this question will often guide the employee in their decision of whether or not to drop their group coverage and opt for Medicare instead.

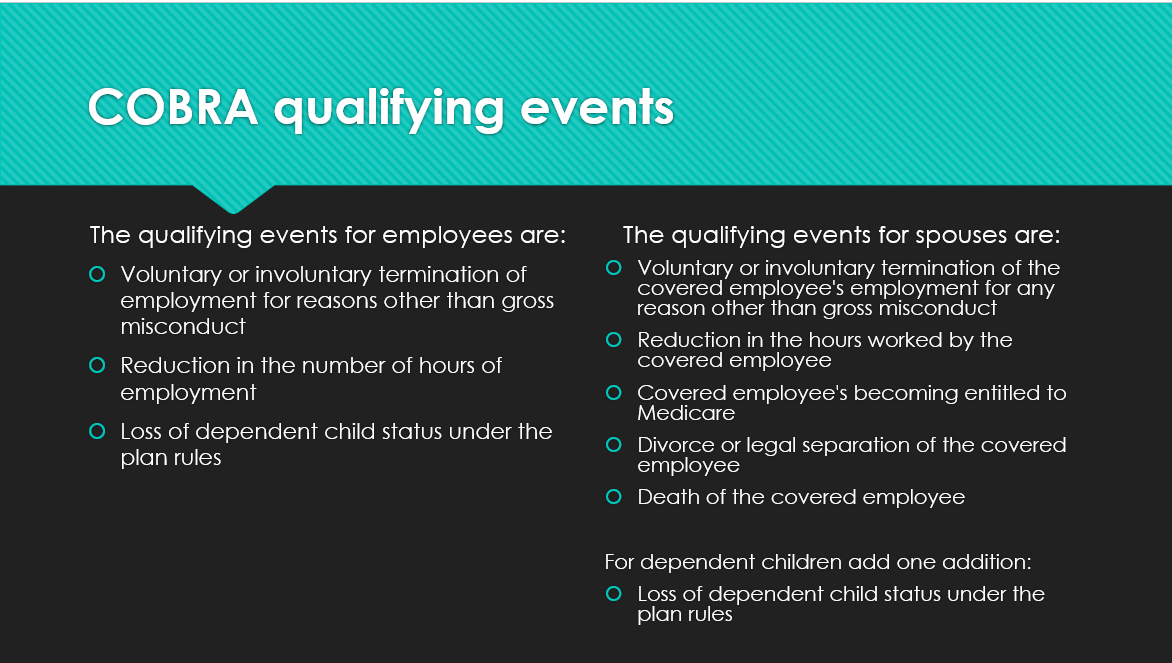

Cobra refers to a federal law that allows employees and their covered dependents to continue their group health insurance for a period of time after they would otherwise lose that coverage due to a qualifying event. Qualifying events are defined as follows:

COBRA qualifying events are certain events that would cause an individual to lose group health coverage. The type of qualifying event will determine who the qualified beneficiaries are and the amount of time that a plan must offer the health coverage to them under COBRA. A plan may, at its discretion, provide longer periods of continuation coverage.

At first glance it would appear clear that “the Covered employee’s becoming entitled to Medicare” is a qualifying event that would allow the employee’s dependents to maintain group coverage under Cobra. Unfortunately, it’s more complicated than that.

The law states that the qualifying event has to “cause” the loss of coverage. In the case of Medicare, federal law forbids an employer from forcing an employee off of the group plan just because they are eligible for Medicare. In fact, the company cannot even offer any inducement to the employee to encourage them to choose Medicare over the group plan. Given these restrictions it is highly unlikely that the employee’s entitlement to, or even enrollment in Medicare would ever “cause” the loss of group coverage.

What does this all mean?

It depends. A strict reading of the law would indicate that if a Medicare eligible active employee chooses Medicare and terminates their group coverage it would be a voluntary termination resulting in no Cobra option for the spouse and dependent children. Not everyone has chosen to interpret the law that way however, and some carriers will still allow the spouse and dependent children to choose the Cobra option.

Employers will need to advise employees who cover spouses and/or dependents on their group health plan that dropping this coverage in favor of Medicare may result in a loss of coverage to their family members. Those family members would then be on their own to try and procure coverage elsewhere. Employers should check with their insurance broker or carrier to see what the carrier’s policy is regarding Cobra for dependents of Medicare enrolled employees.

Ultimately it is a decision that the employee should begin considering well before turning age 65. If employers have employees who are, or will be turning, age 65 in the near future, they should consult with their health insurance broker as early as possible in order to help the employee determine which option is best for them and their families and to be certain that the employer is in compliance will all of the rules and regulations surrounding Medicare and active employees.

With so many employers approaching their open enrollment period at this time of year it is a good time to have these types of conversations. Maybe you could even include some educational materials in your enrollment packet/documents. We can help you spread the word among your employees with flyers and educational posters.

Leave a comment